The Occupy Wall Street movement has all but died--at least in the headlines--but in recent weeks more and more mainstream elites have come out against the excesses of the financial giants, reviving the impulse to break up the big banks. In the Financial Times, Sebastian Mallaby wrote last week that given the revelations about how the financial giants manipulated Libor, it's time "to consider a more radical approach." Invoking a trust-busting Teddy Roosevelt, he writes: "Modern banks are worse than the rail and oil conglomerates of yesteryear. They must be broken up."

Mallaby echoes the conclusions of a 2010 paper by Andrew Haldane, head of the Bank of England’s financial-stability department, who showed that the financial crisis of 2008-09 produced an output loss equivalent to between $60 trillion and $200 trillion for the world economy. What that means is that overall, our unrestrained financial sector does not add any net benefit to the economy—its repeated crises cost us far more than Wall Street brings to overall economic growth.

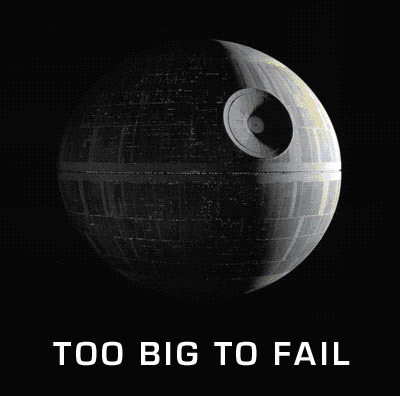

In the neoconservative Weekly Standard, Irwin Stelzer today asks why Mitt Romney, who knows the issues as well as anyone because he ran Bain Capital, isn't calling for breakup of the banks himself. "They are too big to fail, and too complicated to regulate. So where is he when economists say that the better alternative is not more of the failed policies of the Obama years—regulating the unregulatable, bailing out when all else fails —but breaking up the big banks? Not for vulgar populist reasons, but to improve the functioning of the capital markets."

Welcome to the club, guys. It is indeed past time to revive this debate. All this echoes what I wrote, most recently, in May, after the disclosure that even sainted Jamie Dimon and his J.P. Morgan don't really understand what their traders are up to:

1.) An even bigger problem than Too-Big-to-Fail is Too Big to Understand. WE CAN'T KEEP UP WITH WHAT THE BANKS ARE DOING, FOLKS. Even they can't -- even the smartest of them, like arrogant old Jamie. The beauty of something like Glass-Steagall was that it solved that problem by ensuring that no matter how arcane trading got, the STRUCTURAL separation of risk-taking investment banks from federally insured commercial banking would do the job of protecting the system. Regulators, even in the best of times, are always going to be outpaced by the complexity and speed of markets. That's what's all but gone now, despite loophole-riddled Volcker Rule.

And 2.) As I wrote at length in Capital Offense, Wall Street and its lobbyists in Washington continue to pretend that finance works like other markets in goods and services. It doesn’t and never can. In 1983, a young Stanford economist named Ben Bernanke published the first of a series of papers on the causes of the Great Depression. The financial system, Bernanke said, was not unlike the nation’s electrical grid. One malfunctioning transformer can bring down the whole system. (And, in fact, the deregulation of the electricity market later proved disastrous in states like California.) Bernanke showed that it was a broad-based collapse of the banking system that turned the postcrash downturn into the Great Depression. “I’ve never had a laissez-faire view of the financial markets,” Bernanke told me much later. “Because they’re prone to failure.” Even Milton Friedman, at one point, praised the idea of depository insurance. It was a lesson that William Seidman, the head of the Resolution Trust Corporation that unwound the savings and loan crisis, later noted began with Adam Smith: “Banking is different. . . . Financial systems are not and probably never will be totally free-market systems.”

The work of Joe Stiglitz and others shows that market efficiency is undermined by imperfect information, and there is no market more governed by information than finance. Information is, in fact, the main “good” or “service” that financial markets purvey. As Yves Smith has pointed out in her book Econned, supply and demand don't even work the same way in finance. In normal macroeconomics, higher prices usually lead to reduced demand. In finance, higher asset prices usually lead to more lending, which in turn leads to more asset purchases. Before you know it, you have a mania and a bubble. Conversely, falling asset prices and credit contractions reinforce each other in a downward spiral. In other words, in financial markets there is no tendency toward equilibrium either on the way up or down.

Finance is, by its nature, a dangerous beast. One that can't be domesticated and so must be caged.

Some of the most brilliant and prescient work in this area was done by Hyman Minsky, an obscure economist at the University of California at Berkeley and Washington University who did more than anyone to flesh out Keynes’s vaguely stated skepticism about financial markets. Minsky’s “Financial Instability Hypothesis” held that success in financial markets always breeds its own instability. The longer a boom lasts, the less market players consider failure a possibility; as a result, careful borrowing, lending, and investment inevitably give way to recklessness and speculative euphoria. Margins and capital cushions come to be seen as unnecessary. At a certain watershed, or “Minsky moment,” as it came to be called, the foreordained collapse begins. The most speculative bets crash, loans are called in, asset values plunge, and the downward spiral feeds on itself.

Yet amid the free-market triumphalism of the post–Cold War era, all this hard-won wisdom about finance was forgotten or ignored. (An assessment of Minsky in 1997, a year after he died, concluded that his “work has not had a major influence in the macroeconomic discussions of the last thirty years.) It continued to be ignored even after the worst financial catastrophe since the Great Depression.

And despite the latest proof of Wall Street's tendency to run amok on its own, the debate over regulation is still led by champions of revanchism like Jamie Dimon (and Mitt Romney). This is still the thinking that dominates Washington today. Can we have, at long last, a real debate about the recurring crisis generator that is Wall Street?

No comments:

Post a Comment